We all face significant increases in the cost of living. This means many consumers are finding new ways to save money – sometimes through brand-switching. It’s not easy to predict which products people are happy to switch and which will continue to sell as normal. We spill the beans on own-brand products to see if there had been a rise in sales versus branded products.

In the following products own-brand has increased share compared to branded sales. It would be worthwhile making sure these own-branded products are prominent in-store.

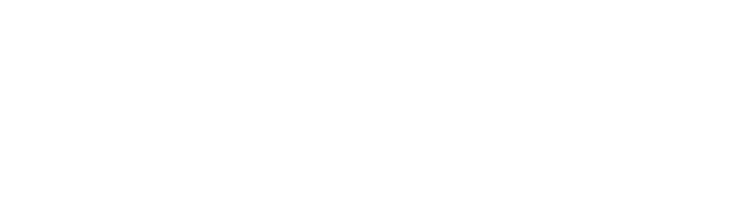

Total Baked Beans sales are up 2.5% year on year. Heinz remains the biggest selling brand with over half the sales, but declined -5.1% compared to 2021. Euroshopper has grown market share 13.5% year on year. Branston has increased by 7.4% and accounts for around 9% of unit sales. HP beans have declined by -21.9% year on year so maybe there is switching between these brands.

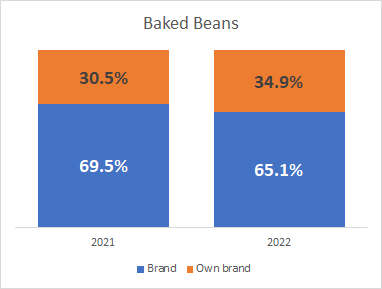

Toilet Tissue sales have grown by 17.3% compared to last year (we compared unit sales to avoid confusion). In 2021, Andrex was the biggest selling brand with 29.6% of sales; in 2022 they are in second place with 26.9% of sales. Euro Shopper has increased to first place with 30.4% of sales in 2022. Sales are dominated by 4-packs in both years so it’s not the case that consumers are switching to smaller packs. C-store footfall is higher than last year suggesting that shoppers are visiting local stores more often, and this may continue to increase as it is cheaper to walk to the local shop than drive to the supermarket.

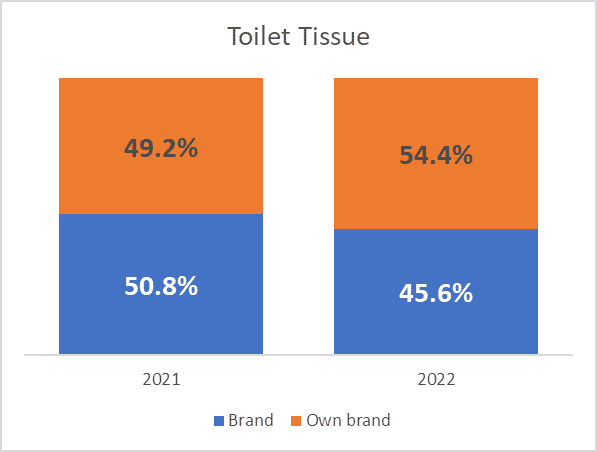

Tomato Ketchup sales have grown 7.1% this year. Heinz remains the biggest seller and has grown 3.0%, but own brand has grown more.

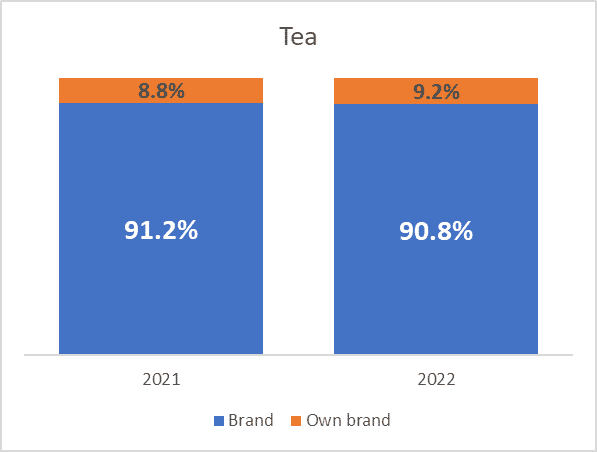

Tea sales have increased 1.3% compared to last year. Brands dominate with Tetley, Taylors of Harrogate & PG Tips taking the top 3 spots, although Taylors is the only brand to have higher sales than last year.

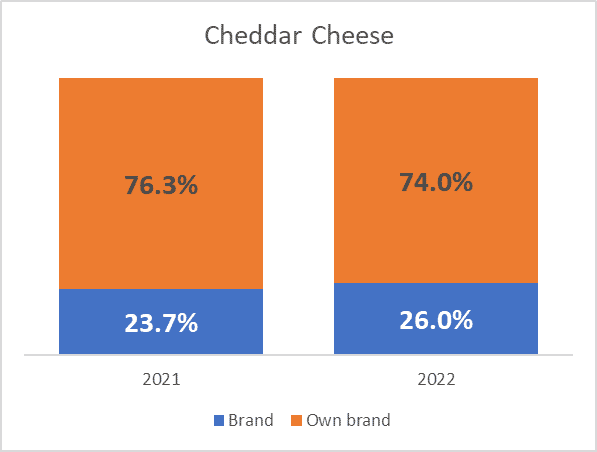

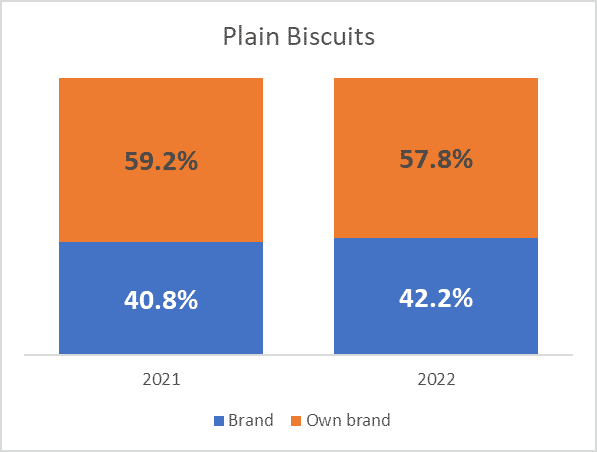

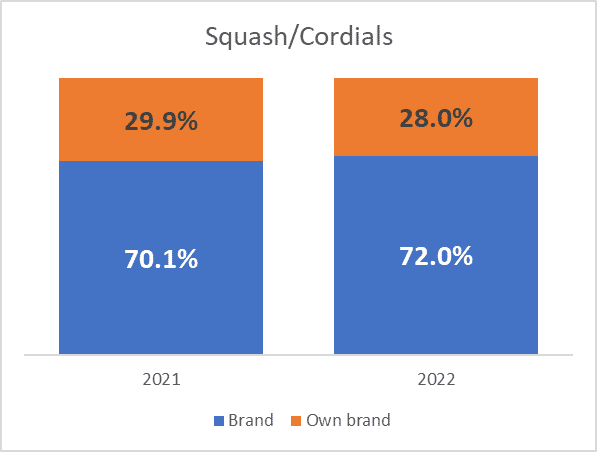

Not all products have seen a marked switch to the own-brand label. Is this because consumers feel that only the branded product will do? In the following products there has been growth in market share for the branded product – we investigated whether the branded product was subject to an offer in each case.

Sales of Cheddar cheese are up 12.3% year on year. Cathedral City is the biggest selling brand in the number 2 spot. Sales have grown 19.0% compared to the previous year. The average selling price for Cathedral City was below the Marked Price for March, April and May 2022.

Plain Biscuits have grown 7.1% in 2022. McVities retain the number 2 spot with growth of 12.2% year on year. All price marked packs (PMP) are selling at marked price suggesting there were no promotions on this product.

These products have grown 3.0% compared to last year. Robinsons is the dominant brand with 37.5% of sales and growth of 4.7%. Fruit Creations have sold for less than the price marked on the pack in 3 of the 6 months in 2022.

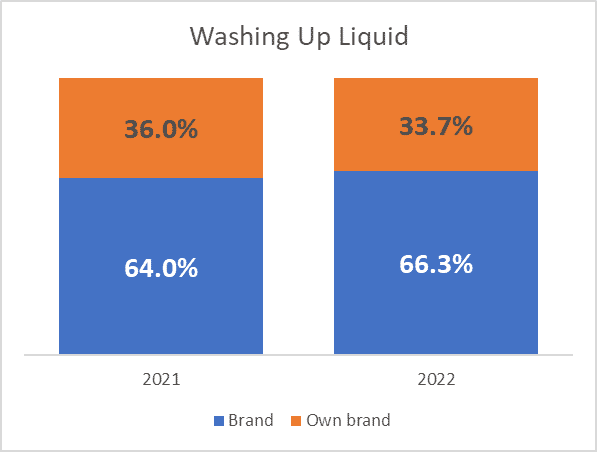

Washing Up Liquid has grown 19.6% year on year. Fairy continues to dominate with 62.6% of sales and has grown by 25.3% compared to the previous year. All price marked packs were sold at marked price.

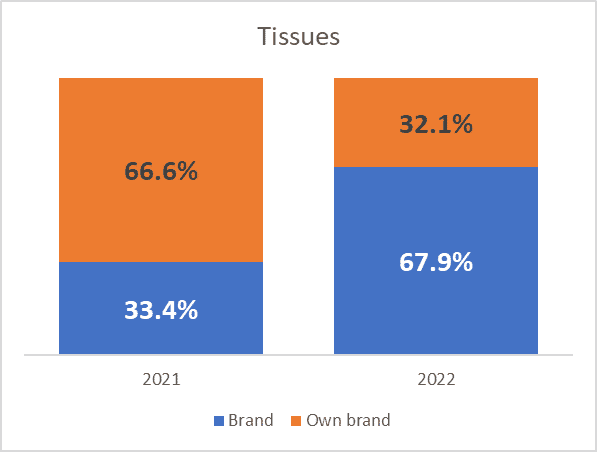

There has been a marked change in tissue sales year on year. Sales have declined by -19.6%. The biggest selling brand is Kleenex with 59.1% of sales, compared to 30.8% last year, moving them from number 2 to number 1. Euro Shopper were selling in around 1800 stores in 2021, and just 800 in 2022. Kleenex XL Compact were selling in around 600 stores in 2021, and 1100 in 2022.

Stores may benefit from highlighting the own-brand range that they carry at this time – certainly we’ve seen the supermarkets do this in recent weeks. Stores should especially concentrate on the lines above, baked beans, toilet tissue, ketchup and tea that have seen a rise in own-brand market share.